+ Payments

We do that.

Our integrated software and hardware help you streamline all of your everyday tasks. That means you get to focus your time and energy on building your business and providing the great services your customers love.

Get a $450 statement credit when you buy Station, Mini or Flex*

Competitive transaction rates and top-of-the-line technology. We do that.

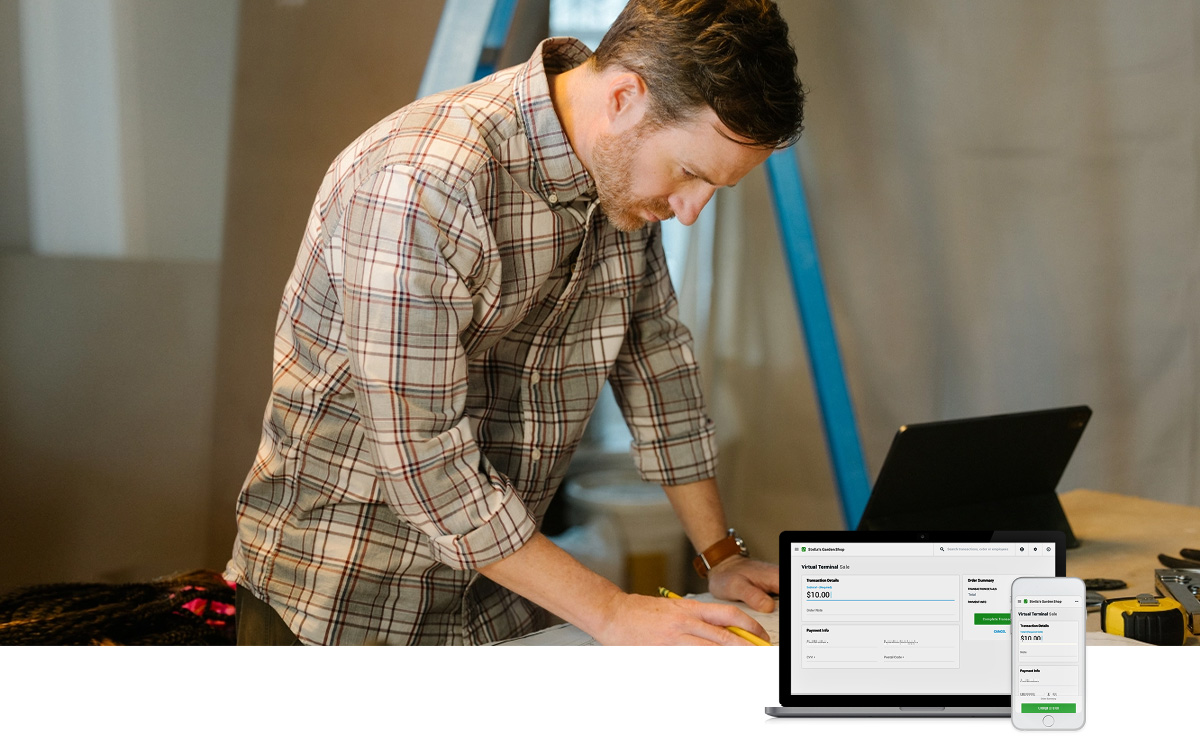

Start taking payments and improving your business today on your laptop or mobile device.

Get a $450 statement credit when you buy Station, Mini or Flex*

Expert consultants to help your business thrive.

Setup specialists

are ready to help

Clover is easy to self-install, but we also offer free hands-on or remote setup assistance.

A trusted

business advisor

Our consultants help you make the most of apps and tools suited to your business.

Free 24/7

live support

Get help however you need it—online, by phone, or in person.

What your business can do with Clover

What your business can do with Clover

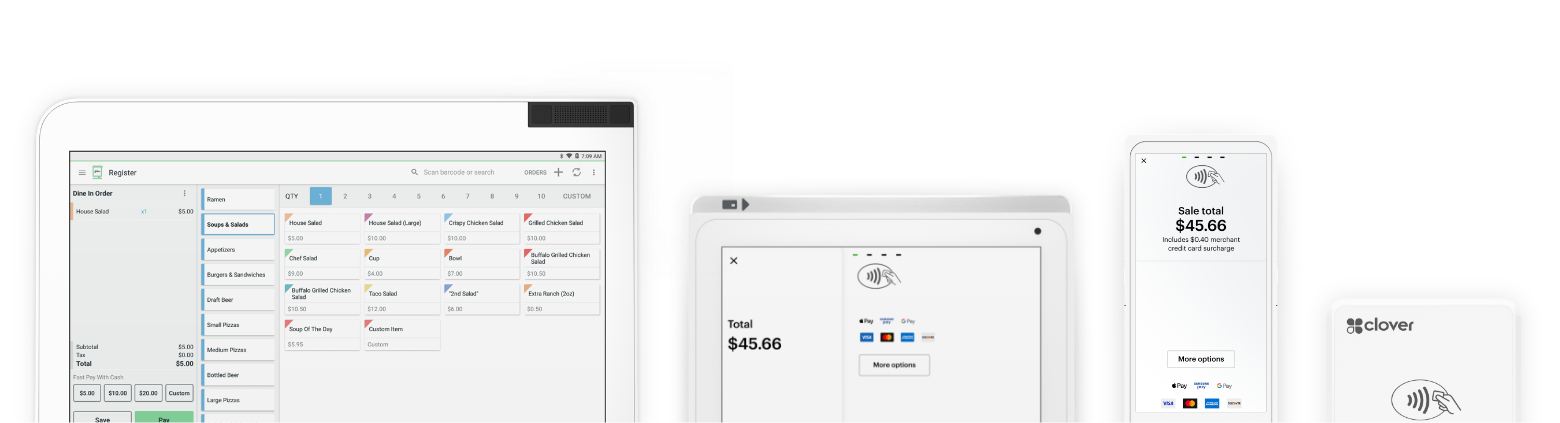

ACCEPT PAYMENTS ANYWHERE

Accept contactless, mobile, gift card, check, credit, debit, or digital wallet payments — all on the same system. Even when the Wi-Fi goes down.

MAKE APPOINTMENTS ONLINE

With Clover, it’s easy to take appointment bookings online and set up automatic reminders. Did someone say “no more no-shows”?

SIMPLIFY STAFF MANAGEMENT

Clover makes it faster and simpler to manage those who keep your business buzzing. Set employee permissions and logins, schedule shifts, and run payroll — all on one system.

GET YOUR CASH FASTER

Time is money, so getting your money shouldn’t take too much time. Clover Rapid Deposit works to transfer funds to your account in minutes, not days.

EASILY MANAGE INVENTORY

Keep an eye on your inventory without the hassle. Clover makes tracking product sales simple, so you always know whether or not there’s one more in the back.

GROW YOUR CUSTOMER BASE

Create marketing campaigns, manage promotions, and rewards with powerful customer engagement tools.

COMPARE |

CLOVER |

SQUARE |

| Processing fee per swipe, dip, or tap | Starting at 2.3% + 10¢ | 2.6% + 10¢ |

| Debit-card PIN transactions | ||

| Fingerprint security | ||

| 4G/LTE backup connectivity | ||

| Unlimited employee roles | Free | $35/location |

| Customer rewards program | Free | Start at $45/month |

| 24/7 customer support | ||

| World’s largest payment processor | ||

| Largest selection of apps | ||

AFFORDABLE PLANS

Our system is designed to help you manage your payments and so much more with affordable plans starting at just $9.95/month.

ACCESS ANYWHERE, ANYTIME

Our cloud-based POS system lets you track and manage your business anywhere, anytime.

BETTER TOOLS WITH A TAP

You know your business best. With Clover, you get access to a huge library of integrations and apps to help you run it better.

A solution for every kind of service? Clover does that.

FIND YOUR SOLUTION

SEE WHAT WE'VE BUILT FOR YOU

9 things to consider when choosing your POS system

1. What are the setup and transaction costs?

Yes, software and hardware come at a cost, but pay closest attention to the fees. Each POS system charges processing fees for in-person and online transactions. Put some thought into how much of each sale is going toward your system.

2. What are your hardware needs?

In addition to looking at the design and durability of your machines, make sure to think about the variety of hardware your services-based business needs to operate effectively. Does the system offer POS terminals, credit card readers, contactless options, and touch screens? Can you take mobile payments chair-side or at job sites for work on-the-go?

3. How will it support your business now, and as it grows?

Think of everything that running your business requires; then, ask if your POS software can help. Can it schedule appointments, track employee schedules, and generate cash-flow reports? The best tools for your business work as an extension of you, making your daily tasks easier.

4. How easy is it to learn and use?

You have a job. You don’t want to be a full-time POS-system troubleshooting expert. How easy is it to learn how to use the system? Does it help you be more efficient or does it complicate things even more? Is it built to work even if the Wi-Fi fails?

5. What type of payment methods do your customers prefer?

It’s often called a Point of Sale, but it’s really a Point of Taking Payments. How many different types of payment can your system accept? Can it take cash, debit, and credit cards? What about mobile-wallet payments? How about sending invoices and taking payments online?

6. Will it keep your business and customer data safe?

Your POS system doesn’t just protect your data, it also protects your customers’ personal information. Look for systems with reliable end-to-end encryption, integrated EMV chip sensors, and biometric security.

7. Do you need a cloud-based system?

If your system operates within the cloud, you can streamline and automate managerial tasks, install updates with ease, and access your data on any secure web or mobile platform, no matter where your work takes you.

8. Can you access the right data, quickly?

Quick, immediate access to your data can empower you to make critical business decisions in real time. A system that offers insights and analysis into that data can help you plan and execute effective growth strategies for your business.

9. Can you get help if you need it?

Your POS system—just like your business—should have a human component. Make sure that you’ll have live advice and support from a real person—whether you’re troubleshooting a problem or figuring out how to get the most from your equipment.

Build your Clover POS system

Choose your plan, device, and accessories in just a few steps

9 things to consider when choosing your POS system

Yes, software and hardware come at a cost, but pay closest attention to the fees. Each POS system charges processing fees for in-person and online transactions. Put some thought into how much of each sale is going toward your system.

In addition to looking at the design and durability of your machines, make sure to think about the variety of hardware your services-based business needs to operate effectively. Does the system offer POS terminals, credit card readers, contactless options, and touch screens? Can you take mobile payments chair-side or at job sites for work on-the-go?

Think of everything that running your business requires; then, ask if your POS software can help. Can it schedule appointments, track employee schedules, and generate cash-flow reports? The best tools for your business work as an extension of you, making your daily tasks easier.

You have a job. You don’t want to be a full-time POS-system troubleshooting expert. How easy is it to learn how to use the system? Does it help you be more efficient or does it complicate things even more? Is it built to work even if the Wi-Fi fails?

It’s often called a Point of Sale, but it’s really a Point of Taking Payments. How many different types of payment can your system accept? Can it take cash, debit, and credit cards? What about mobile-wallet payments? How about sending invoices and taking payments online?

Your POS system doesn’t just protect your data, it also protects your customers’ personal information. Look for systems with reliable end-to-end encryption, integrated EMV chip sensors, and biometric security.

If your system operates within the cloud, you can streamline and automate managerial tasks, install updates with ease, and access your data on any secure web or mobile platform, no matter where your work takes you.

Quick, immediate access to your data can empower you to make critical business decisions in real time. A system that offers insights and analysis into that data can help you plan and execute effective growth strategies for your business.

Your POS system—just like your business—should have a human component. Make sure that you’ll have live advice and support from a real person—whether you’re troubleshooting a problem or figuring out how to get the most from your equipment.